Saving for Retirement

Purchasing a home

Managing your Debt

Buying a new car

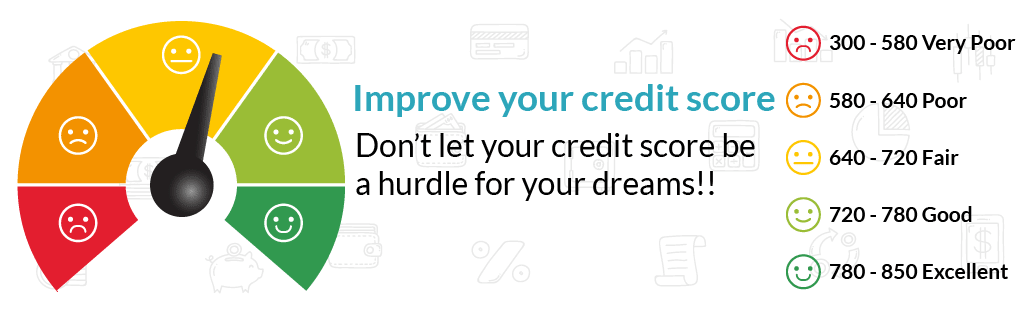

Improve your credit score

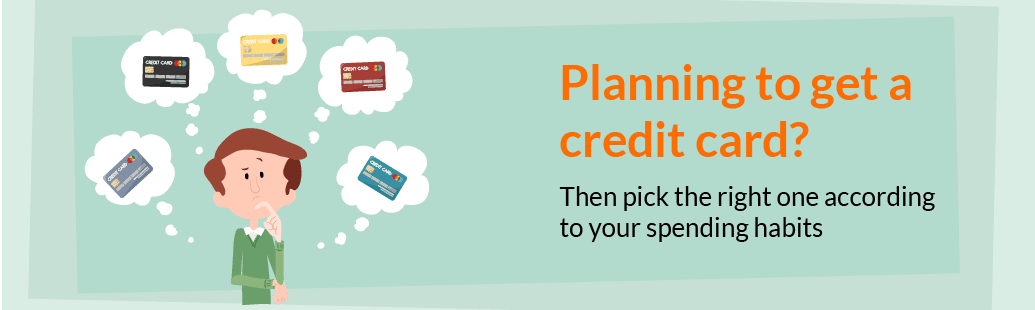

Choosing the best credit card