Credit Bureau Consent, Welcome Offer & General Terms & Conditions

I hereby acknowledge and agree to allow Citibank to share my details with any UAE credit bureau and make enquiries about me with any UAE credit bureau at its sole and absolute discretion. I agree to the Terms and Conditions listed below. Citibank Terms and Conditions apply, are subject to change without prior notice and are available upon request. For the current Terms and Conditions, please visit our website www.citibank.ae. All offers are made available on a best-effort basis and at the sole discretion of Citibank, N.A. Citibank, N.A. makes no warranties and assumes no liability or responsibility with respect to the products and services provided by partners/other entities. By inquiring about our services, offers or products, you will be authorizing our representatives to approach you on your contact details including your telephone/mobile number for any product or service offered by Citibank. The applicant agrees to be bound by Citibank’s General Terms and Conditions available on the website www.citibank.ae. The applicant hereby represents and warrants that the information provided herein is true, accurate, and complete and that he/she agrees to remain responsible for and to indemnify Citibank, N.A. from and against any losses, claims and/or liabilities incurred by Citibank NA as a result of having relied on such information. Citibank, N.A. is not required to verify the information provided by the applicant and neither is the bank obliged to provide the applicant with any loans or credit facilities based on the provided information. The products and services mentioned on this website are not offered to individuals resident in the European Union, European Economic Area, Switzerland, Guernsey, Jersey, Monaco, San Marino, Vatican, The Isle of Man or the UK. This page is not, and should not be construed as, an offer, invitation or solicitation to buy or sell any of the products and services mentioned herein to such individuals.

FAB Prepaid Cards in UAE

Eligibility Criteria of FAB Prepaid Card

The eligibility criteria of the FAB prepaid card varies with each card.

- For Ratibi Prepaid Card, the employer issuing the card must have a corporate account at FAB

- Only companies are eligible to get a FAB prepaid card

- FAB eDirham Prepaid Card can be availed by UAE residents or non-residents as well

First Abu Dhabi (FAB) Prepaid Card

17 Prepaid Cards Provided By First Abu Dhabi (FAB)

Government Black Corporate Card

Features

- The cost of the card is AED 25 which will be deducted from the first load

- The Corporate cards require KYC/KYB (Know Your Customer/Know Your Business) registration, no bank account required

- The card has five years validity

Features

- The cost of the card is AED 25 which will be deducted from the first load

- The Corporate cards require KYC/KYB (Know Your Customer/Know Your Business) registration, no bank account required

- The card has five years validity

- The Maximum card balance is AED 10,000,000

- The card can be used for government transactions

- The Government Black Corporate Card can be loaded or reloaded through: FAB Cash Deposit Machines (CDMs)

- FAB iBanking corporate

- Distribution channels and MBME Kiosks

- The UAE Funds Transfer System (UAEFTS)

- The loading and reloading fees is as follows:

- FAB Cash Deposit Machines (CDMs): AED 5

- MBME Kiosks: AED 5

- Distribution channels and iBanking: AED 5

- The UAE Funds Transfer System (UAEFTS): AED 5

Benefits

- The maximum card balance is AED 10,000,000

- The maximum load amount is AED 10,000,000

- Maximum reload amount per transaction at FAB CDMs is AED 75,000

- The Maximum reload amount per day at FAB CDMs is AED 75,000

- The Maximum reload amount per month at FAB CDMs is unlimited

- The Cards can be purchased and applied for through the following channels

- - Magnati offices

- - FAB’s website (www.bankfab.com)

- - FAB iBanking (will be available soon)

- Cash withdrawals are not permitted for corporate cards.

- This card is available to all UAE-registered companies.

Government Sahala Individual Card

Features

- The prepaid card can be issued without any registration or any bank account

- Easy issue prepaid card with Initial limit AED 3,500

- The card issuance cost is AED 15 which will be deducted from the first load

Features

- The prepaid card can be issued without any registration or any bank account

- Easy issue prepaid card with Initial limit AED 3,500

- The card issuance cost is AED 15 which will be deducted from the first load

- Limit of AED 50,000 once KYCed completed

- The prepaid card has a validity of five years as per expiry date which is pre-printed on the card

- The initial loading amount is limited to AED 3500 which is maximum for government transactions

- For merchant payments and reloads a KYC (Know your customer) has to be completed with a max limit of AED 50,000

- You can do Government and non-government transactions Enjoy Visa offers will be applicable

- You can get the Visa deals and great offers applicable on card

- This prepaid card offers simple loading and reloading of funds which will help you to track your transactions.

- This is a Five-years validity card

Benefits

- Government Sahala Individual Cards are available at Magnati Offices and the distribution channels.

- The maximum card balance transaction at FAB CDMs reload amount per month which is not registered is AED 3,500

- The maximum card balance transaction at FAB CDMs reload amount per month which is with Full registration or Full KYC is AED 50,000

- The maximum amount of prepaid card reload per day at FAB CDMs for one time transaction is AED 3,500

- The maximum amount of prepaid card reload per day at FAB CDMs for one time transaction with full registration or full KYC is AED 50,000

- There are loading and reloading fees. The following are the fees for loading and reloading.

- - FAB Cash Deposit Machine charges- AED 5

- - MBME Kiosks- AED 5

- - Distribution channels and iBanking- AED 5

- - The payit mobile app- AED 5

- - The FAB Mobile app, Online Banking- AED 5

- - The UAE Funds Transfer System - AED 5

- You can get a balance refund on a prepaid card. The balance amount can be refunded at FAB ATMs provided if cash withdrawal is available.

- The prepaid card user can request for a refund with a government prepaid card at a Magnati office. The requests with incomplete details will not be processed

- The withdrawal allowance per transaction is AED 10,000 and for those with full KYC withdrawal per day is AED 50,000 and withdrawal allowance per month is unlimited.

- The cash withdrawals are available only for KYC completed users and cash withdrawals can be made at FAB and non FAB ATMs.

- The FAB ATMs are free and no charges are applicable for withdrawals

- The non FAB ATMs within the UAE charge AED 2 per withdrawal and non FAB ATMs outside UAE charge 2.5 percent on withdrawals or AED 15 per withdrawal whichever is greater. The redemption fee is AED 25

- The Government Sahala Individual Card can be loaded or reloaded through:

- FAB Cash Deposit Machines (CDMs)

- The FAB Mobile app and Online Banking for retail

- FAB iBanking for corporate

- The payit mobile app (available soon)

- Distribution channels and MBME Kiosks

- The UAE Funds Transfer System (UAEFTS)

Government Advanced Individual Card

Features

- The maximum card balance is AED 75,000

- The card cost is AED 25 which will be deducted from the first card load

- The personalized card requires Know your customer registration and no bank account is required

Features

- The maximum card balance is AED 75,000

- The card cost is AED 25 which will be deducted from the first card load

- The personalized card requires Know your customer registration and no bank account is required

- This card is valid for five years from the date of issue.

- The visa platinum deals and offers are applicable

- The card can be used for government transactions and other merchants

- The government advanced individual card can be loaded and or reloaded through the following.

- Distribution channels and MBME Kiosks

- FAB Cash Deposit Machines (CDMs)

- The UAE Funds Transfer System (UAEFTS)

- The FAB Mobile app and Online Banking for retail

- The payit mobile app

- FAB iBanking for corporate

Benefits

- The maximum card balance is AED 75,000

- The maximum load amount is AED 75,000

- The Maximum reload amount per transaction at FAB CDMs is AED 35,000

- The Maximum reload amount per day at FAB CDMs is AED 35,000

- The Maximum reload amount per month at FAB CDMs is AED 1,050,000

- The cash withdrawals are available at FAB and non FAB ATMs The cards can be purchased and applied through the following channels.

- FAB’s website (www.bankfab.com)

- Magnati offices

- The payit mobile app

- FAB’s website The FAB Mobile app and Online Banking

- Free cash withdrawals at FAB ATMs

- AED 2 is charged for non FAB ATMs within the UAE

- For withdrawals outside the UAE country charges of 2.5% or AED 15 whichever is higher is applicable

- The loading/reloading fees can be done through the following

- MBME Kiosks: AED 5

- Distribution channels and iBanking: AED 5

- FAB Cash Deposit Machines (CDMs): AED 5

- The FAB Mobile app, Online Banking: AED 5

- The UAE Funds Transfer System (UAEFTS): AED 5

- The payit mobile app: AED 5

- The redemption fee is AED 25

- The Withdrawal allowance per transaction is AED 10,000

- The Withdrawal allowance per day is AED 75,000

- The withdrawal allowance per month is unlimited

- Eligibility is available to all UAE Nationals and residents

- The Documents required for the Government Advanced Individual Card are as follows:

- Completed application form

- Valid Emirates ID (front and back)

- Completed FATCA Individual Form

- The prepaid card balance refund can be availed at FAB ATMs if cash withdrawal is available.

- You can request for a refund for balance on the government prepaid card at Magnati office, bank account transfer only and no cash refunds. The incomplete refund requests will not be processed.

Government Silver Corporate Card

Features

- The Card cost is AED 25 which will be deducted from the first load.

- Corporate cards require KYC/KYB (Know Your Customer/Know Your Business), registration details, no bank account is required

- The corporate card is valid for Five years

Features

- The Card cost is AED 25 which will be deducted from the first load.

- Corporate cards require KYC/KYB (Know Your Customer/Know Your Business), registration details, no bank account is required

- The corporate card is valid for Five years

- The Maximum card balance is AED 2,500,000

- The card can be used for government transactions and other merchants by corporates

- There are Visa deals and offers applicable on the card usage

- The Government Silver Corporate Card can be loaded or reloaded through:

- FAB Cash Deposit Machines (CDMs)

- FAB iBanking for corporate

- Distribution channels and MBME Kiosks

- The UAE Funds Transfer System (UAEFTS)

Benefits

- Cash withdrawals are not permitted for corporate cards Available to all UAE-registered companies.

- The corporate cards can be purchased and applied through the following channels.

- Magnati offices

- FAB’s website (www.bankfab.com)

- FAB iBanking (available soon)

- The Government Silver Corporate Card includes the following features:

- The maximum card balance and maximum load balance is AED 2,500,000

- Maximum reload amount per transaction at FAB CDMs is AED 75,000

- The Maximum reload amount per day at FAB CDMs is AED 75,000

- Maximum reload amount per month at FAB CDMs is unlimited

- The Loading/Reloading Fees are as follows.

- FAB Cash Deposit Machines (CDMs): AED 5

- MBME Kiosks: AED 5

- Distribution channels and iBanking: AED 5

- The UAE Funds Transfer System (UAEFTS) : AED 5

Abu Dhabi Pay Hayyak Card

Features

- The card is easy to issue prepaid card with or without registration or any bank account

- The cards validity is five years from the date of issue

- The starting loading amount is limited to a maximum amount of AED 3,500 and this can be used on Abu Dhabi Pay govt transactions only.

Features

- The card is easy to issue prepaid card with or without registration or any bank account

- The cards validity is five years from the date of issue

- The starting loading amount is limited to a maximum amount of AED 3,500 and this can be used on Abu Dhabi Pay govt transactions only.

- The merchant payments and other reloads will be enabled after the full KYC is done and this will provide a maximum limit of AED 50,000

- The card will offer easy loading of funds and reloading of funds. You can keep track of your spendings.

- The Abu Dhabi Pay Hayyak Card can be loaded or reloaded through the following.

- FAB Cash Deposit Machines (CDMs)

- The FAB Mobile app and Online Banking for retail

- FAB iBanking and Nafura for corporate

- The payit mobile app (available soon)

- Distribution channels and government counters (available soon)

- UAE Funds Transfer System (UAEFTS)

- No card issuance cost, loading or reloading fees

- Hayyak Cards are available at Magnati offices and government counters.

Benefits

- If cardholder full KYC is not done then maximum card balance is AED 3,500

- For all the KYC completed cardholders the maximum card balance is AED 50,000

- The card can be loaded or reloaded and the below are the various options available.

- FAB Cash Deposit Machines (CDMs): Free

- Distribution channels and government counters: Free(available soon)

- The FAB Mobile app and Online Banking: Free

- FAB iBanking and Nafura: Free

- The payit mobile app: Free (available soon)

- UAEFTS: Free

- For all the cardholders without KYC the maximum load amount is AED 3,500 on one time basis

- For KYC completed users the maximum load amount is AED 50,000

- Any kind of reload is not allowed for cardholders who have not completed their KYC

- For KYC completed users the max reload per day and transaction at FABs CDM is AED 50,000 and the maximum reload is unlimited

- The balance amount may be refunded on FAB ATMs if there is cash withdrawal provided to them.

- You can also place a request at Magnati offices to get your refund of balance on your Abu Dhabi Hayyak Card, the incomplete refund requests are not processed.

- For KYC users Withdrawal allowance per transaction is AED 10,000

- For KYC users Withdrawal allowance per day is AED 50,000

- For KYC users Withdrawal allowance per month is unlimited

- The cash withdrawal facility is provided at any FAB and Non FAB ATMs, the withdrawal facility is available only for the KYC completed customers.

- Cash withdrawal at FAB ATMs is free of charge

- AED 2 is charged for cash withdrawals at Non-FAB ATMs

- For all the International withdrawals AED 15 or 2.5 percent is charged whichever is greater

Abu Dhabi Pay Diamond Individual Card

Features

- There are no charges for card issuance, loading fees or reloading fees

- The card can be used for Abu Dhabi Government transactions and other merchants

- The card is valid for five years from the date of issuance The Maximum card balance is AED 75,000

Features

- There are no charges for card issuance, loading fees or reloading fees

- The card can be used for Abu Dhabi Government transactions and other merchants

- The card is valid for five years from the date of issuance The Maximum card balance is AED 75,000

- Personalized card requires KYC (Know Your Customer)

- registration and no bank account is required

- Abu Dhabi Pay Diamond Individual Card offers easy loading and reloading of funds which will help you keep track of your spendings.

- Abu Dhabi Pay Diamond Individual Card can be loaded or reloaded through the following ways

- FAB Cash Deposit Machines (CDMs)

- The FAB Mobile app and Online Banking for retail

- FAB iBanking and Nafura for corporate

- The payit mobile app (available soon)

- Distribution channels and government counters (available soon)

- UAE Funds Transfer System (UAEFTS)

Benefits

- Abu Dhabi Pay Diamond Individual Card maximum card balance is AED 75,000

- The maximum load balance is AED 75,000

- The Maximum reload amount per transaction at FAB CDMs is AED 75,000

- The Maximum reload amount per day at FAB CDMs is AED 75,000

- The Maximum reload amount per month at FAB CDMs is unlimited

- The Cards can be purchased/applied for through the following channels

- Magnati offices

- FAB’s website (www.bankfab.com)

- The FAB Mobile app and Online Banking (available soon)

- The payit mobile app (available soon)

- There are no card issuance costs if the customer chooses to collect them from Magnati offices. If the customer requests delivery, there will be a charge of AED 25*.

- The Cash withdrawals are available at any FAB and Non-FAB ATMs. Below are the charges for the withdrawals.

- FAB ATMs: Free.

- Non-FAB ATMs (within UAE): AED 2

- International withdrawals: 2.5% or AED 15 (whichever is higher)

- The withdrawal allowance per transaction is AED 10,000

- The withdrawal allowance per day is AED 75,000

- The withdrawal allowance per month is unlimited

- The card is available to all UAE Nationals and residents The documents required for getting this card are completed application form, Valid Emirates ID (front and back) and Completed FATCA Individual Form

- The balance amount may be refunded on FAB ATMs if a cash withdrawal feature is available.

- You may place a request at Magnati offices to receive a refund of the balance of your Abu Dhabi prepaid card.

- Incomplete refund requests cannot be processed.

Abu Dhabi Pay Elite Corporate Card

Features

- There are no charges for card issuance, loading or reloading fees

- The card can be used for Abu Dhabi government transactions and other merchants by corporates

- The card is valid for Five-years from the date of issue The Maximum card balance is AED 2,500,000

Features

- There are no charges for card issuance, loading or reloading fees

- The card can be used for Abu Dhabi government transactions and other merchants by corporates

- The card is valid for Five-years from the date of issue The Maximum card balance is AED 2,500,000

- Corporate cards require KYC/KYB (Know Your Customer/Know Your Business) registration, no bank account required Abu Dhabi Pay Elite Corporate Card can be loaded or reloaded through the following channels

- FAB Cash Deposit Machines (CDMs)

- FAB iBanking and Nafura

- Distribution channels and government counters (available soon)

- UAE Funds Transfer System (UAEFTS)

Benefits

- The maximum card balance is AED 2,500,000

- The maximum card load is AED 2,500,000

- The Maximum reload amount per transaction at FAB CDMs is AED 75,000

- The Maximum reload amount per day at FAB CDMs is AED 75,000

- The Maximum reload amount per month at FAB CDMs is unlimited

- The card loading and reloading fees are as follows

- FAB Cash Deposit Machines (CDMs): Free

- Distribution channels and government counters: Free(available soon)

- FAB iBanking and Nafura: Free

- UAE Funds Transfer System Free(UAEFTS)

- Corporate can can be purchased/applied through:

- Magnati offices

- FAB’s website (www.bankfab.com)

- FAB iBanking (available soon)

- There are no issuance costs if the customer chooses to collect them from Magnati offices. If the customer requests card delivery, there will be a charge of AED 25

- Cash withdrawals are not permitted for corporate cards.

- All the UAE registered companies are eligible for getting this card

- The balance amount may be refunded on FAB ATMs (if cash withdrawal feature is available)

- The card user can place a request at Magnati offices to receive a refund of the balance of your Abu Dhabi prepaid card. Please note that incomplete refund requests cannot be processed.

Abu Dhabi Pay Excellence Corporate Card

Features

- There are No card issuance costs and no loading or reloading fees

- The card can only be used for Abu Dhabi Government transactions by corporates

- Card is valid for five years from the date of issue

Features

- There are No card issuance costs and no loading or reloading fees

- The card can only be used for Abu Dhabi Government transactions by corporates

- Card is valid for five years from the date of issue

- The Maximum card balance is AED 10,000,000

- Corporate cards require KYC/KYB (Know Your Customer/Know Your Business) registration, no bank account is required The card offers easy loading and reloading of funds to help you keep track of your spending.

- The Card can be loaded or reloaded through the following ways

- FAB CDMs

- FAB iBanking and Nafura

- Distribution channels and government counters (available soon)

- UAE Funds Transfer System (UAEFTS)

- The card loading and reloading can be done through the following channels.

- FAB Cash Deposit Machines (CDMs): Free

- Distribution channels and government counters: Free (available soon)

- FAB iBanking and Nafura: Free

- UAE Funds Transfer System (UAEFTS): Free

- Cash withdrawals are not permitted for corporate cards.

Benefits

- The Maximum card balance is AED 10,000,000

- The Maximum load amount is AED 10,000,000

- The Maximum reload amount per transaction at FAB CDM is AED 75,000

- The Maximum reload amount per day at FAB CDMs is AED 75,000

- The Maximum reload amount per month at FAB CDMs is AED unlimited

- The card can be purchased/applied for through:

- Magnati offices

- FAB’s website (www.bankfab.com)

- FAB iBanking (available soon)

- There are no card issuance costs if the customer chooses to collect them from Magnati offices. If the customer requests delivery, there will be a charge of AED 25.

- The balance amount on the card may be refunded on FAB ATMs (if cash withdrawal feature is available)

- The card user may place a request at Magnati offices to receive a refund of the balance of your Abu Dhabi prepaid card. The incomplete refund requests cannot be processed.

Wafer Individual Card

Features

- The card issuance cost is AED 30 which will be deducted from the first load

- It is easy issue prepaid card without registration or a bank account

- The card is valid for five years from the date of issuance

Features

- The card issuance cost is AED 30 which will be deducted from the first load

- It is easy issue prepaid card without registration or a bank account

- The card is valid for five years from the date of issuance

- The Initial load amount will be limited to maximum AED 3,500 and this can be used on the RAK Pay government transactions only.

- Reload and cash withdrawal capabilities will be enabled once the full KYC (Know Your Customer) is completed and this is with a maximum limit of AED 10,000

- This card offers easy loading and reloading of funds to help you keep track of your spending.

- The Wafer Individual Card can be loaded or reloaded through the following channels

- FAB Cash Deposit Machines (CDMs)

- The FAB Mobile app and Online Banking for retail

- The payit mobile app (available soon)

- Distribution channels (available soon)

- MBME Kiosks

- The UAE Funds Transfer System (UAEFTS)

- The card loading or reloading fees is as follows

- FAB Cash Deposit Machines (CDMs): AED 10

- MBME Kiosks: AED 10

- Distribution channels: AED 10 (available soon)

- The FAB Mobile app, Online Banking and iBanking: AED 5

- FAB Branch and Nafura: AED 25

- The payit mobile app: AED 5 (available soon)

- The UAE Funds Transfer System (UAEFTS) : AED 5

- The Wafer Individual Card is available at Magnati offices, FAB RAK branches and distribution channels

Benefits

- Card users who are not registered the maximum card balance is AED 3,500

- Card users who completed KYC get maximum card balance and maximum load balance of AED 10,000

- Card users who are not registered the maximum load amount is AED 3,500 one time only

- Maximum reload amount per transaction at FAB CDMs is not allowed for non registered users

- Maximum reload amount per transaction at FAB CDMs for KYC users is AED 10,0000

- Maximum reload amount per day at FAB CDMs for KYC users is AED 10,000

- Maximum reload amount per month at FAB CDMs for non KYC users is not allowed

- Maximum reload amount per month at FAB CDMs for KYC users is unlimited reload

- Withdrawal allowance per transaction for KYC users is AED 10,000

- Withdrawal allowance per day for KYC users is AED 10,000

- Withdrawal allowance per month for KYC users is unlimited The balance amount can be refunded at FAB ATMs (if the cash withdrawal feature is available).

- The card user may request a refund at Magnati offices.

- Incomplete refund requests cannot be processed.

- The cash withdrawals are available at any FAB or non FAB ATM. Note that cash withdrawal is available only for KYC completed customers.

- FAB ATMs: Free

- Non-FAB ATMs )within the UAE): AED 2

- International withdrawals: 2.5% or AED 15 (whichever is higher)

- The redemption fee at FAB branches is AED 25

Al Ruzmah Corporate Card

Features

- The cost of the card is AED 30 which will be deducted from the first load

- The Corporate cards will require KYC/KYB (Know Your Customer/Know Your Business) registration, no bank account required

- The Maximum card balance of AED 2,500,000

Features

- The cost of the card is AED 30 which will be deducted from the first load

- The Corporate cards will require KYC/KYB (Know Your Customer/Know Your Business) registration, no bank account required

- The Maximum card balance of AED 2,500,000

- The card is valid for a period of five years from the date of issue

- The Al Ruzmah Corporate Card can be loaded or reloaded through:

- FAB Cash Deposit Machines (CDMs)

- FAB iBanking and Nafura (available soon)

- Distribution channels (available soon)

- MBME Kiosks

- The UAE Funds Transfer System (UAEFTS)

- The loading or reloading fees is as follows

- FAB Cash Deposit Machines (CDMs): AED 10

- MBME Kiosks: AED 10

- Distribution channels: AED 10 (available soon)

- FAB iBanking: AED 5 (available soon)

- FAB Branch and Nafura (available soon): AED 25

- UAE Funds Transfer System (UAEFTS) : AED 5

Benefits

- The Maximum card balance is AED 2,500,000

- The Maximum load amount is AED 2,500,000

- The Maximum reload amount per transaction at FAB CDMs is AED 75,000

- The Maximum reload amount per day at FAB CDMs is AED 75,000

- The Maximum reload amount per month at FAB CDMs is unlimited

- The prepaid card can be purchased/applied for through the following channels.

- Magnati offices and FAB RAK branches

- FAB’s website (www.bankfab.com)

- FAB iBanking (available soon)

- Cash withdrawals are not permitted for corporate cards.

- All the UAE registered companies are eligible for getting Al Ruzmah Corportate Card

- The balance amount may be refunded at FAB ATMs if the cash withdrawal feature is available.

- You may request a refund at Magnati offices, incomplete refund requests cannot be processed.

PayRow Individual Card

Features

- The card issuance cost is AED 30 which will be deducted from the first load

- The card used for Government transactions and other merchants

- The Personalized card requires KYC (Know Your Customer) registration, no bank account required

Features

- The card issuance cost is AED 30 which will be deducted from the first load

- The card used for Government transactions and other merchants

- The Personalized card requires KYC (Know Your Customer) registration, no bank account required

- This card is valid for a period of Five-years from the date of issue

- The Maximum card balance is AED 75,000

- The PayRow Individual Card can be loaded or reloaded through the following channels

- FAB Cash Deposit Machines (CDMs)

- The FAB Mobile app and Online Banking for retail

- The payit mobile app (available soon)

- Distribution channels (available soon)

- MBME Kiosks

- The UAE Funds Transfer System (UAEFTS)

- The Loading/Reloading Fees are as follows

- FAB Cash Deposit Machines (CDMs): AED 10

- MBME Kiosks: AED 10

- Distribution channels: AED 10 (available soon)

- The FAB Mobile app, Online Banking and iBanking: AED 5

- FAB Branch: AED 25

- The payit mobile app: AED 5 (available soon)

- The UAE Funds Transfer System (UAEFTS) : AED 5

- The redemption fee is AED 25

Benefits

- The Maximum card balance is AED 75,000

- The Maximum load amount is AED 75,000

- Maximum reload amount per transaction at FAB CDMs is AED 75,000

- Maximum reload amount per day at FAB CDMs is AED 75,000

- The Maximum reload amount per month at FAB CDMs is unlimited

- Cash withdrawals are available at any FAB or non-FAB ATM and the following are the charges

- FAB ATMs: Free

- Non-FAB ATMs (within the UAE): AED 2

- International withdrawals: 2.5% or AED 15 (whichever is higher)

- The Withdrawal allowance per transaction is AED 10,000

- The Withdrawal allowance per day is AED 75,000

- The Withdrawal allowance per month is unlimited

- All UAE Nationals and residents are eligible for getting PayRow Individual Card

- The balance amount can be refunded at FAB ATMs if the cash withdrawal feature is available.

- You may request a refund at Magnati offices and remember incomplete refund requests cannot be processed.

PayBlue Corporate Card

Overview

- The documents required for the PayBlue Corporate Card are as follows

- Completed PayBlue Corporate Card Application Form

- Valid Emirates ID (front and back)

Overview

- The documents required for the PayBlue Corporate Card are as follows

- Completed PayBlue Corporate Card Application Form

- Valid Emirates ID (front and back)

- Company Trade Licence/registration document

- Certificate of Incumbency (if applicable)

- Proof of address

- Official company letter

- Power of Attorney (POA)/Board Resolution

- Memorandum/Articles of Association (if applicable)

- Completed FATCA Entities Form

- Company bank statement (three months)

Ratibi Prepaid Card

Features

- Employees don’t have to maintain any minimum balance

- Unlimited access to a huge network of ATMs and CDMs

- Complimentary personal accident cover offered with the card

Features

- Employees don’t have to maintain any minimum balance

- Unlimited access to a huge network of ATMs and CDMs

- Complimentary personal accident cover offered with the card

Benefits

- For Employees:No need to maintain a bank account [no minimum balance requirement or any incidental charges]

- Eliminates delay in receiving salary [including cheque clearing delays or processing delays]

- Automated process which ensures maximum efficiency in processing

- No need to carry cash around

- Easy and safe way to receive your salary

- Balance can be checked online

- Receive an alert when your salary is credited [Free of cost]

- Access to VISA/MasterCard worldwide networks

- Can be used for cash withdrawal [at ATMs] and online and offline shopping [EFTPOS]

- 24 hours support through a call center for query resolution if any

- You can visit an FAB ATM and select your Personal Identification Number [PIN]

- Completely compliant with the guidelines laid down by the Wages Protection System [WPS], UAE

- Complimentary accident insurance. You are eligible for five times your monthly salary [subject to a maximum of AED 25,000] in the case of an accidental death or permanent total disability caused by an accident.

- You can avail a daily cash benefit of AED 50 [subject to a maximum period of 30 days/AED 1500] for hospitalization costs due to the accident if any. The minimum period is 24 hours.

- In the case of death, the cost involved in the repatriation of your mortal remains will be reimbursed up to AED 5,000.

- For Employers: A payroll payment system that is easy and convenient

- Manage all Ratibi cards of your employees online

- Individual company requirements for salary processing can be serviced too

- Transfer salaries from your corporate account to individual Ratibi cards in a secure manner using the online banking service

- An efficient and automated service with a team of dedicated professionals to help you with queries, if any

- A single bank transfer can credit salaries to all you employees holding Ratibi prepaid cards

- Eliminates the risk involved in handling cash.

- Pay wages in local currency at considerably lower costs

- Non-WPS payroll processing available. You can send bulk files through FAB’s secure electronic channel with debit instructions from your corporate account

Payment Prepaid Card

Benefits

- FAB Payment Prepaid Card does not need activation

- Bank account is not needed

- There are no monthly charges levied

Benefits

- FAB Payment Prepaid Card does not need activation

- Bank account is not needed

- There are no monthly charges levied

- No minimum balance requirement in the card

- Can use the card at domestic and international stores

- Free statements are provided

- Can withdraw cash at FAB ATMs for free

- Free online balance enquiry

Prepaid Gift Card

Features

- This is a Gift card that can't be reloaded

- Can fund the card from a corporate card

Features

- This is a Gift card that can't be reloaded

- Can fund the card from a corporate card

Benefits

- KYC is not required for the cardholder

- Can be used as a Corporate Gift for the employees

Multi-Currency Prepaid Card

Features

- FAB Multi-Currency Prepaid Card is entitled for government entities in the UAE

Features

- FAB Multi-Currency Prepaid Card is entitled for government entities in the UAE

Benefits

- Up to 24 currencies can be availed

- Funded by Government entities in the UAE

- Can reload multiple cards in bulk

- Dedicated customer support 24/7

- Fixed foreign exchange rates are charged

DWallet Prepaid Card

Features

- A prepaid card introduced for Domestic Workers in UAE

- Can transfer the funds to DWallet Prepaid Card for the Domestic Worker

- Sponsors need to visit TAD-BEER centre with the identity proofs to apply for a DWallet card

Features

- A prepaid card introduced for Domestic Workers in UAE

- Can transfer the funds to DWallet Prepaid Card for the Domestic Worker

- Sponsors need to visit TAD-BEER centre with the identity proofs to apply for a DWallet card

- Can topup the DWallet card at TAD-BEER centre, TAD-BEER app or Lulu Exchange centre

Benefits

- Cardholders (Domestic workers) can avail several features like transfer funds, mobile top-ups, etc. with payit.

- Can be used at ATMs for cash withdrawals

- Can be used at offline outlets

- Can transfer money worldwide

- Free Personal Accident Insurance is provided

- High discounts are provided

Benefits

- The bank account is not needed for the cardholders

- Can reload the card easily

- Can use it any merchant that accepts Visa or Mastercard cards

- Can use it for cash withdrawal

- Can use it for online transactions, bill payments, etc

- Cardholders can get transaction statements for free

- No minimum balance requirement

- Provides a mobile app

- Can get the details of the prepaid card easily using the online portal

- An exclusive card for government entities i.e. Multi-Currency Prepaid Card

- Can use the eDirham cards at government entities as well

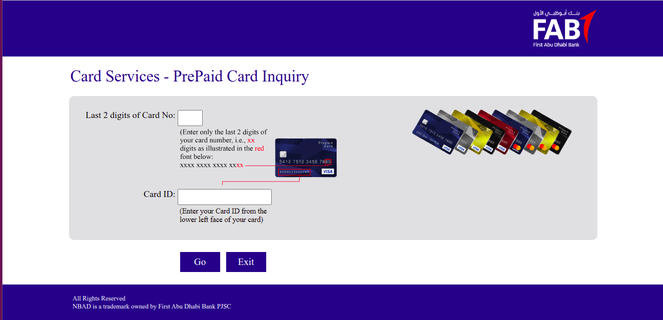

How to check FAB Balance?

FAB Balance enquiry can be done in a simple and convenient way through the following steps. Through FAB Bank Balance Check, you can find out the balance available in your prepaid card, transaction history on the card, and recharge the card accordingly.

Keep your FAB prepaid card available during FAB Balance Check.

- Visit the FAB Prepaid Card Balance Enquiry page that the Prepaid card Enquiry System

- Enter the last two digits of the prepaid card.

- Ex: If your card number is “1234 1234 1234 5678”, Enter “78”

- Enter the Card ID provided on the prepaid card. Every prepaid card consists of the card id which is a unique combination of letters and numbers. Enter the ID without any errors.

- Click on GO

- You will find your available balance on the top along with other basic details like Name, Card Number, Status, etc.

You can also check the latest 10 transactions by default. You can also check the transactions by giving start and end dates.

Prepaid cardholders can get free and convenient FAB balance enquiry by following these simple steps.

Reloading FAB Prepaid Cards

After the FAB balance enquiry, you can reload your prepaid card as per the maximum balance on the card and also the load amount per day.

Prepaid cards can be reloaded by, like

- Visiting any FAB ATMs centers or

- On FAB prepaid online portal

FAB Bank Salary Check

FAB salary check process is simple and easy through FAB prepaid card enquiry system page. Have your FAB prepaid card ready and follow the below steps for the FAB salary check:

- Open FAB Prepaid card enquiry system page

- Enter the last two digits of your prepaid card number in the first column provided on the page.

- Every prepaid card is given an ID on the left side of the card at the bottom. Enter the complete ID given below the card number in the next box on the page.

- Verify the details you've entered

- Click on "GO"

You can check FAB salary and balance details on the profile. The FAB online balance checking is available at any time of the day on no charges.

Frequently Asked Questions

Q. Can we reload the gift card as well?

A. No. The Prepaid Gift card is loaded once by the corporate and gifted. The maximum amount on it is AED 3500 and can’t be reloaded.

Q. Can individuals avail the FAB prepaid cards?

A. No. FAB Prepaid cards are exclusive for the corporates. However, individuals can avail FAB eDirham Prepaid Cards.

Q. How to activate the FAB prepaid card?

A. There is no separate activation required for the FAB prepaid cards.

Q. Are there any charges levied for FAB balance enquiry?

A. No. FAB Balance enquiry is provided for free which can be availed at any time and anywhere.

Q. Do we need to get an account at FAB to get the prepaid card?

A. Only for FAB Ratibi Prepaid Card, the company needs to hold a FAB corporate account. For other cards, the cardholders need not have an account in FAB.

Q. Can we reset the PIN of the prepaid card?

A. Yes. You can reset your FAB prepaid card PIN by visiting the Prepaid Online Portal.

Q. What are the documents required for non-residents to get the FAB eDirham Prepaid Card?

A. Non-residents need to provide a copy of the passport as the document to get FAB eDirham Prepaid Card.

Q. Is it mandatory to have FAB account for the prepaid card?

A. No. There is no FAB account required for the prepaid cards.

Q. Are there any charges on FAB (NBAD) salary check?

A. No. You can perform FAB salary check for free through FAB PPC page.

Q. Can we get balance enquiry of any prepaid card?

A. No. You can get FAB prepaid card balance only on FAB website.

Q. Can we get details of money credited in the prepaid card on FAB balance enquiry page?

A. Yes. You can check money credited and debited into your prepaid card on FAB balance enquiry page.

Q. Can we check FAB prepaid card balance even if I don't have card?

A. If you have the details of your FAB prepaid card, then you can login and check the card balance.

About FAB

First Abu Dhabi Bank (FAB) is one of the largest banking institutions established in 2017 and is a merger of NBAD and FGB. FAB offers tailor made solutions, products and services to the customers.The international network of FAB is spread over 5 continents providing global relationships, expertise and financial strength to local and international business. FAB offers its diversifying services by having differentiation, agility and innovation as their main motto and vision

Get in touch with FAB Bank Customer Care

Click here to get FAB Bank SWIFT Code