In order to take control of your finances, you need to master the art of budgeting. A budget is a plan detailing how you must spend your money to achieve your financial goals. If you have a budget in place, then you can plan your finances so that you manage your expenses and save some funds for a rainy day. There are many ways of creating an effective budget. In this article, we will talk about the 50-30-20 budget rule and how you can use it to create a budget that works.

Why do you need to create a Budget?

Whether it is a country or an individual, a budget is a great tool to create a plan to outline how the money is spent. It allows you to gain control over finances by controlling your expenses. Usually, most of us spend our money without realizing how and where our hard-earned money is slipping away. Hence, having a tool to help track them and a strategy to minimize unnecessary expenses can help build a financially secure future. Once you start budgeting, you will be surprised to see the amount of money you spend on things that are irrelevant or avoidable.

Steps for setting up a Budget

The basic logic of setting up a budget is creating a detailed list of your income and expenses. If you are budgeting for the first time, then you can start by looking at your income and expense trends over the last six months. Here are some simple steps that will allow you to create an effective budget:

1. List your monthly Income

Cover all possible avenues of income like your salary, monthly incentives, returns on investments (like Fixed Deposit interest, mutual fund dividends, etc.), and any other income sources. If you are an entrepreneurial spirit and running a part-time business venture, then work out an average amount that you can withdraw from the business every month. The idea is to have a clear picture of your monthly income.

2. Detailed list of your monthly expenses

This is an important list because you will want to take care of all important expenses while doing away with the less important ones. Create a list that carries all the important expenses at the top and list them down in the order of decreasing importance. So, the first entry on the list must be your most important expense (like house rent) and the last entry must be the least important one (usually luxury-related expenses).

3. Assess your financial position

By now, you should have a clear picture of your income and expenses. Compare your income and expenses:

Having Income greater than Expenses: This means that you have surplus funds left with you at the end of every month. You can use these funds to repay debts (if any) or build an emergency fund or create an investment plan.Having Income less than Expenses: This is where most of us find ourselves (unfortunately so). You need to now look at your expenses sheet and figure out ways to cut back on them so that you save some money at the end of every month.

The idea is simple, by the end of Step 3, you must know which expenses you can avoid, what amount of money you will be left with every month, and how you plan to use it. You need to create an upper limit for expenses in each category so that you can control the overall expenses in the month.

4. Tracking Mechanism

A budget is not effective if you do not track it regularly. You can use a budgeting software or a simple excel sheet to help you track. List down your daily expenses under the categories created in Step 3. As the month progresses, if you find that you have over-spent in a particular category, then you can cut back on another category to make up for it. For example, imagine that you budget AED 300 monthly for dining out but by the 20th day of the month, you have already spent AED 360. Now, in order to stick to your budget, you can cut back on entertainment costs to cover up for it. You can achieve this only if you have a tracking mechanism to analyze your expenses every day.

5. Be Consistent

Budgeting can seem difficult at the start but it gets easier as you get accustomed to it. Ensure that you repeat this process every month and learn from the mistakes and achievements of the previous months.

There are many budgeting techniques to help create an effective budget like the envelope budget, 50-30-20 budget, 5-category budget, etc. It is important to remember that each one of us is different and needs a strategy that suits our requirements. Hence, you need to look at different budget strategies before finalizing them. Today, we will be talking about the 50-30-20 budget rule and how it can help you.

Check: Reasons why your Budget fails tips to overcome it

What is the 50-30-20 Budget Rule?

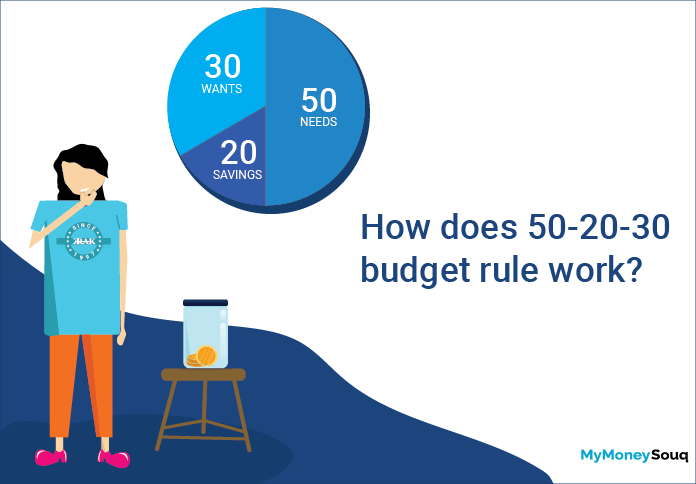

The 50-30-20 (or 50-20-30) budget rule is one of the most popular strategies of budgeting used around the world. The core working principle of this rule is dividing your expenses into three main categories: Needs, Wants and Savings or Debt.

This makes it easier for you to determine where you want to spend your money and helps you focus on how you want to do it.

To create a budget using this rule, you need to follow Step 01 mentioned above that helps you list your monthly income (post-tax). Once you have that number, you need to divide your income as follows:

- Needs – 50% of your post-tax monthly income

- Wants – 30% of your post-tax income

- Savings and/or Debt – 20% of your post-tax income

For example, if your net monthly income is AED 10,000, then your monthly budget should allocate AED 5000 for needs, AED 3000 for wants, and AED 2000 for savings and/or debt. The next step is determining which expenses constitute needs and which fall under wants. It is easy to get confused between a need and a want. Do you need the full-body massage twice a month or do you want it? Tricky, eh! While this is individual specific, here are some guidelines that you can follow:

1. What are Needs?

In the simplest terms, needs are expenses that are absolutely unavoidable. So, your house rent, utility costs, health care costs (if any), transport costs, etc. are needs. While defining needs you must keep one thing in mind – these are the expenses that you cannot live without.

2. What are Wants?

Wants are typically the expenses that you can cut back on if required since they are avoidable. Think about expenses like dining at restaurants, shopping, vacations, entertainment, luxuries, etc. Wants are expenses that you choose and NOT the ones that you cannot live without.

3. Savings and/or Debt

The last 20% of your income must be dedicated to paying off debt or investing for the future.

Is the 50-30-20 budget rule good for me?

As we mentioned above, all budgeting strategies cannot work for all people – one size does not fit all. Hence, it is important to assess your preferences before determining a budgeting strategy.

This rule is good for people who don’t have the time or inclination to track detailed daily expenses. Since the 50-3-20 rule involves only three categories, all you need to do is quickly jot down your expenses (needs, wants, or savings/debt) once every few days and you are good to go. However, if you are the kind of person who thrives on details and does not mind spending a little extra time every day to improve your spending habits, then you might want to consider another strategy.

This strategy assumes that 50% of your income should be sufficient to cover your living costs. While this might be true in most cases, there can be regions or areas where the cost of living is much higher or lower. Therefore, you might have to tweak the rule accordingly. For example, if the place you live has exorbitantly high rents, then 50% of your income might not be sufficient to meet your needs.

Summing Up

It is important to remember that budgeting strategies can help you create a structured approach to controlling expenses and optimizing your income. The 50-30-20 rule is a simple way to start budgeting provided your circumstances permit. Regardless of the strategy you choose, ensure that you consider your circumstances and create a budgeting plan that is tailor-made for you. We believe that while earning money is difficult, spending it wisely is equally tough but holds the key to a financially secure future. A good budget is an efficient way of ensuring that you spend your hard-earned money on things that are important to you and avoid wasting it on unnecessary expenses. We hope that this article helps you get started on the amazing journey of setting up a budget and controlling your money. Good Luck!

About the author

Nikitha is a Senior Analyst at MyMoneySouq.com. She has been writing about personal finance, credit cards, mortgage, and other personal finance products in the UAE. Her work on Mortgage loans has been featured by the GulfNews and other popular Financial Blogs in the UAE.