Debt Burden Ratio or DBR is a mathematical ratio which banks take into account while deciding whether a particular applicant is eligible for a loan or not. Even though all the banks have a different set of rules as the eligibility criteria while sanctioning, a few things such as the credit score, debt-burden ratio, etc. are some common factors which all the banks follow.

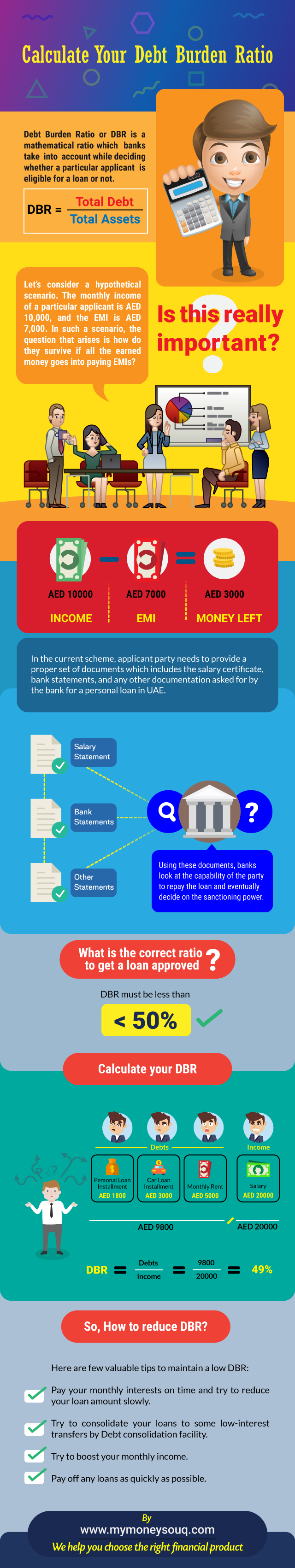

The DBR is calculated as the ratio of the Total Debt the applicant owes to Total Assets the applicant owns. In simpler words, it is the ratio of the debts you have to your average monthly income.

DBR=Total Debt/Total Assets

Calculate your DBR:

You can calculate your DBR easily by taking a ratio of the outgoing money to the monthly income.

Say Mr.X gets a monthly salary AED 15000 and has a few liabilities that need to be attended to every month. Let’s calculate his DBR.

Personal loan Installment = AED 1800

Car Loan = AED 3000

Monthly Rent = AED 5000

Debt Burden Ratio(DBR): Debts/Monthly Income

Total Debts = 1800 + 3000 + 5000 = 9800

Monthly Income = 20000

DBR = 9800/20000 = 49%

Mr.X is eligible to get a new loan as his DBR turns out to be 49%, which is less than the limit of 50%. But we can see that it is very close to the maximum limit. This is good for now. However, if he gets a new loan, this would definitely exceed 50% and he would not be eligible to get another loan unless some of the load is relaxed.

DBR Limit for Loans in UAE

As recently as until past decade, there was no DBR compulsion per se in the UAE. Banks provided loans to applicants whose DBR was hovering around 65%. The upper limit was 65%, and an applicant beyond 65% wasn’t eligible for any kind of loan. 65% was a relaxed criterion, and every applicant could easily have a 65% or less DBR. At that point of time banks provided loans with just bank statements as mandatory documents, which landed banks into a loss when people couldn’t pay their dues. The DBR increases when people procure loans from many banks simultaneously where the monthly interests in UAE for debts sometimes become more than the income. Taking these reasons into consideration, most banks have changed it to 50% as of now.

Is DBR Calculation really important?

Let’s consider a hypothetical scenario. The monthly income of a particular applicant is AED 10,000, and the EMI is AED 7,000. In such a scenario, the question that arises is how do they survive if all the earned money goes into paying EMIs? Situations like this were affecting banks badly. Eventually, the banks began taking stricter measures and have begun checking the debt to burden ratio of the applicant(s).

In the current scheme, applicant party needs to provide a proper set of documents which includes the salary certificate, bank statements, and any other documentation asked for by the bank for a personal loan in UAE. Using these documents, banks look at the capability of the party to repay the loan and eventually decide on the sanctioning power.

Banks in UAE are being more precise about the submission of these documents. With these documents they calculate the debt to burden ratio; if this ratio is less than or equal to 50% the loan is approved, else the loan will be rejected.

What is the correct Debt Burden Ratio to get a loan approved?

To get a loan in UAE, your DBR must be less than 50%. Earlier, the upper limit was 65% where people took advantage of this, started taking many loans which increased the cost of living for them, and banks ended up having to experience losses and arrears in payment collection. As of now, the ratio stands at 50%. Ideally, the debt to burden ratio must be Zero, however, in practical aspects, it must be kept as low as possible.

So, How to reduce DBR?

Here are few valuable tips to maintain a low DBR:

- Pay your monthly interests on time and try to reduce your loan amount slowly.

- Try to consolidate your loans to some low-interest transfers by Debt consolidation facility.

- Try to boost your monthly income.

- Pay off any loans as quickly as possible.

These are a few ways by which you can reduce your DBR and maintain a good credit score.

Debt Burden Ratio was introduced, not just to keep banks on the safer side by giving out lesser loans but also for the people in order to control them from spending unnecessarily and landing into debts. A wise man said, “A bad debt is sacrificing your future needs for your present-day desires”. Keep this in mind and act accordingly.

About the author

Nikitha is a Senior Analyst at MyMoneySouq.com. She has been writing about personal finance, credit cards, mortgage, and other personal finance products in the UAE. Her work on Mortgage loans has been featured by the GulfNews and other popular Financial Blogs in the UAE.