Plastic cards are the most loved cards all over. Currently, around 5 million people in the UAE use Credit cards which is more than half of the population of the UAE. But not even 50% of them are making correct use of it and most of them are still in a state of confusion about the charges. There are a few basic points one has to keep in mind while getting a credit card in order to get a good one to make the best use of it. This begins right from choosing the best credit card.

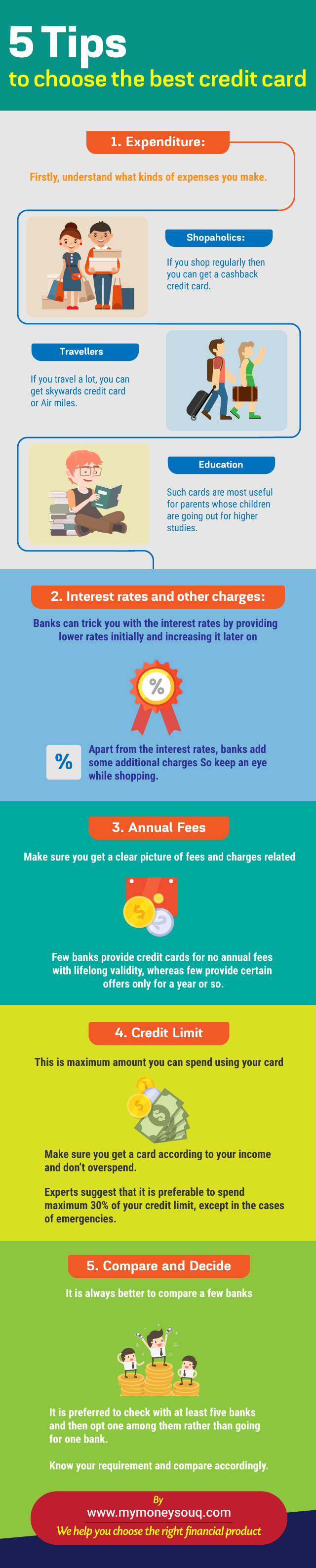

Tips to choose the best credit card:

1. Expenditure:

This is the important thing needed to be analyzed. Firstly, understand what kinds of expenses you make. If you clearly understand your lifestyle and spending pattern, then getting a suitable card is very easy. Because there are several credit cards in UAE for each purpose.

– Shopaholics: If you shop regularly then you can get a cashback credit card UAE.

– Travelers: If you travel a lot, you can get a skywards credit card or any other card that rewards ‘air miles’ on your spendings.

– Education: If you want to get a card for educational purposes, then there are a few banks which provide particular cards for this purpose. Such cards are most useful for parents whose children are going out for higher studies.

2. Interest rates and other charges:

Different cards are associated with different kinds of interest rates in UAE. This is the first thing you must notice once you opt for a card according to your expenditure. Interest rates could be flat rate and reducing rate. Some banks can trick you with the interest rates by providing lower rates initially as an introductory offer and increasing it later on after a year or lesser than, so check with the bank about the rates and payment plan. Apart from the interest rates, banks add some additional charges which would be known only after you get your credit slip after the usage of the card. So keep an eye on the additional charges while shopping.

3. Annual fees:

A few banks provide credit cards for no annual fees with lifelong validity, whereas few provide certain offers only for a year or so. Make sure you get a clear picture of fees and charges related.

4. Credit limit:

This is the maximum amount you can spend using your card which would be associated with your monthly/annual income. Banks boost the credit limit once in a couple of years. The credit limit assigned to a credit card applicant depends on credit history, income and other debts, the credit limit of other cards if any, etc. Make sure you get a card according to your income and don’t overspend. Experts suggest that it is preferable to get a card with a good credit limit if you are eligible and not spend more than 30% of your credit limit except in the cases of emergencies.

5. Compare and decide:

Last but not least it is better to check with at least five banks and then opt one among them rather than going for one bank. Different banks provide different interest rates, annual fees and even offers & rewards. So it is always better to compare a few banks and go for one which is suitable for you.

Also, Read: How many Credit cards one should hold?

These are the 5 very important tips you must consider before getting a credit card which is perfect for you. A healthy credit balance maintenance is essential for a good credit score. Also, choosing the appropriate credit card according to your shopping patterns is always beneficial.

About the author

Nikitha is a Senior Analyst at MyMoneySouq.com. She has been writing about personal finance, credit cards, mortgage, and other personal finance products in the UAE. Her work on Mortgage loans has been featured by the GulfNews and other popular Financial Blogs in the UAE.