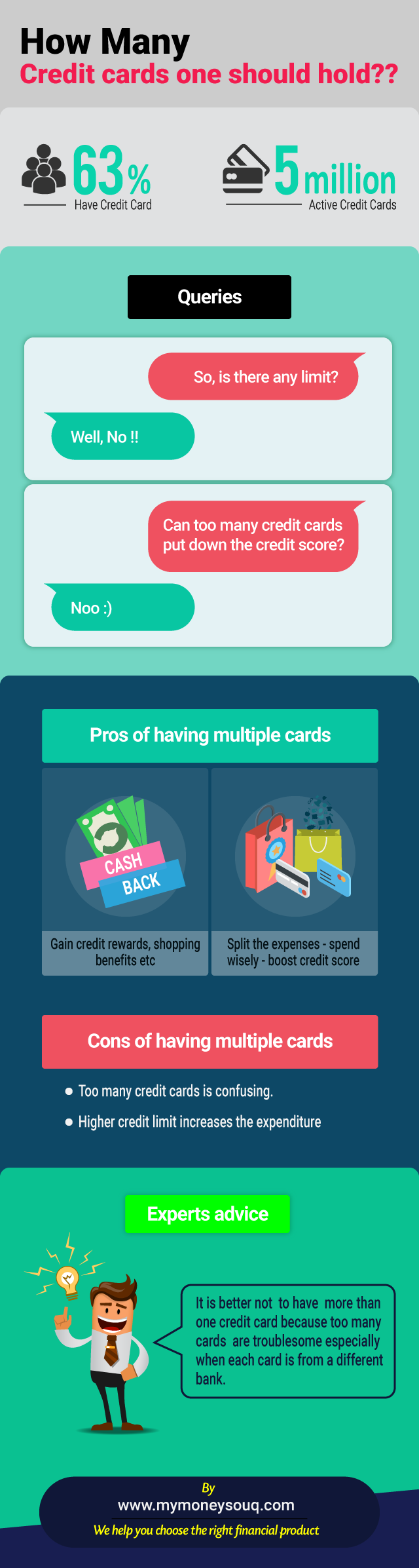

As per a recent survey, around 63% of the people are credit card holders in the UAE. Currently, according to an estimate, there are roughly 5 million active credit cards in circulation. There are less number of debit card users than credit cards in UAE. This adoration for the credit cards is because of the various benefits a holder can get in a credit card right from movie offers to shop benefits, from cash back offers to points redemption etc.

Check: Best Cashback credit card UAE

Coming to the question of how many credit cards should a person hold, there is actually no limit to the number of cards a person can keep. It’s just the game of proper usage. If a person is aware of how to use a credit card, he/she can hold how many ever cards they want. There is a myth that too many credit cards can put your credit score down which is not true.

Pros of having multiple cards:

- If a person knows the usage of credit cards and pays off his/her monthly outstanding bills on time, then having numerous credit cards is a good plan. It could help in gaining credit rewards and perhaps a new card with an exclusive feature/features like shopping benefits, movie offers, air miles etc. which would help in saving money up to 10% monthly. So maintaining two-three cards perfectly could fetch you a great time in savings as there are several credit cards offers provided.

- Apart from rewards, this could be a benefit to the credit score. If a person spends more than 20% of the credit limit then dividing the expenses could be beneficial. And for entrepreneurs, it can be better if they maintain their business and personal expenses on two different cards.

Maybe Interested: How to read AECB Credit report in UAE

Cons of having multiple cards:

Too much of anything is not good, the same way maintaining too many credit cards could be a bit complicated.

- Firstly, maintaining multiple cards can be a struggle, especially if a person doesn’t know how to use a credit card effectively. A recent survey suggests that about 60% of the credit card holders aren’t aware of the interest rates on their cards.

- Secondly, having too many credit cards is ultimately having higher credit limit combinedly which is quite tempting to spend more which could at times become a burden while paying the monthly bills.

Related: Know Credit card charges in UAE

However, there is no limit on a number of cards a person can hold. It is completely up to the user, how he uses and maintains without dropping the credit score. Experts suggest it is better not to have more than one credit card because too many cards are troublesome especially when each card is from a different bank. One should keep an eye on all the cards, interest rates which could lead to payment delays and much more. So it is better to maintain one card properly with regular payments.

About the author

Nikitha is a Senior Analyst at MyMoneySouq.com. She has been writing about personal finance, credit cards, mortgage, and other personal finance products in the UAE. Her work on Mortgage loans has been featured by the GulfNews and other popular Financial Blogs in the UAE.