What is credit score?

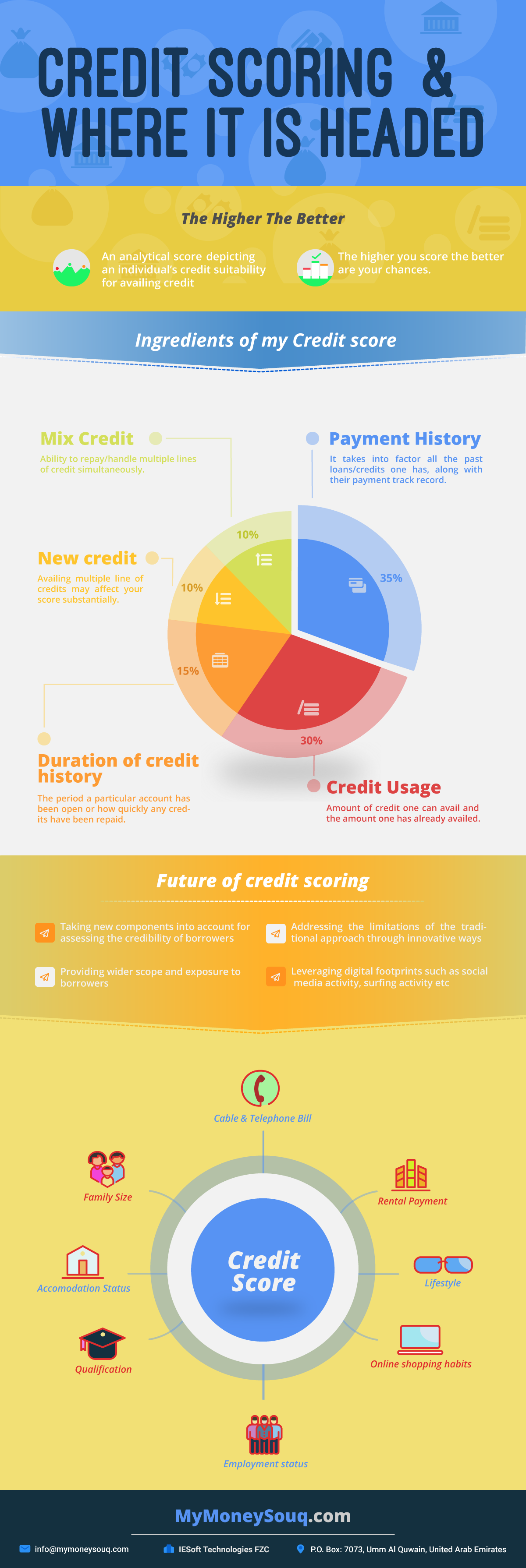

Credit score, in simple terms, refers to the analytical score that depicts an individual’s credit suitability based on which lenders assess the likelihood of an individual’s repayment capability. It is evident that the higher you score, the better are your chances of availing credit.

Getting into the specifics, calculation of the credit score is based on the following five components

Payment history– this head constitutes 35% of the total credit score. It takes into factor all the past loans an individual has had, such as personal loan, student loan, credit card, mortgages and also the applicant’s payment track record so far. This particular component affects your score significantly.

Credit usage– this head constitutes 30% of the total credit score. Credit usage simply refers to the amount of credit available for an individual, that has been already utilized. In other terms, do not exceed your credit limit to score decently in the credit score

Duration of credit history– this particular head constitutes 15% of the total credit score. It refers to the period a particular account has been open or how quickly any credits have been repaid. One of the major drawbacks of this component is that it affects the credit score of an individual who has not yet taken any credit and has no past accounts.

New credit– constitutes 10% of the total credit score. It is recommended that new borrowers should avoid availing multiple lines of credit as it affects their credibility of having a sound financial state

Mix credit– this head constitutes same 10% as the above, and it evaluates the individual on his/her capability of repaying multiple credits.

These five measurement standards are assumed to be quite accurate usually. But like any other method, this method has its drawbacks and eventually, time outruns it.

Future of credit scoring

There are new companies that have come up with innovative ways of credit scoring which can address the limitations in the traditional approach mentioned above.

One such company is Lenddo, a Hong Kong-based startup. They use an entirely different methodology to calculate the credit score. Their method is based on an individual’s Social media footprints. Similarly, Friendlyscore is another UK based company which is focused on providing credit scorecards based on social media accounts.

The wheels of credit scoring have already started turning towards other components available to assess the credibility of borrowers. Digital footprints are being leveraged to breach the gap and to improve the current credit scoring system. This method not only provides the borrowers more exposure and scope but also provides lenders with worthy borrowers, increasing their conversion rate, in turn.

Other potential components that could be used in the future are:

- Cable, telephone bills and rental payments

- Lifestyle and spending habits

- Online shopping habits

- Employment status and history

- Qualification

- Accommodation status (area, own/rent, number of properties)

- Family size (spouse profession, siblings, children)

- Personal accessories ( Brand preferences, gadgets)

- Stock trading habits (risk averse or risk taker)

Most of this information could be gathered from online sources or can be collected from customers by asking them to fill out forms. In the age of technical advancement with big data and data mining options along with open source languages to write self-automated algorithms, it is pretty easy to categorize and simplify large amounts of data helping lenders evaluate the worthiness of a borrower through different parameters by providing a scorecard.

This is just the beginning; we believe credit scoring is heading towards a new and unventured path where some innovative and untapped ways are available for providing a holistic score capturing all the aspects.

About the author

Hemanta Bijoy Kaushik is a personal finance writer. Discovering his love for writing, he has written a number of blogs on personal finances and other genres on various digital media platforms. He has completed his MBA from IMT and currently working at HDFC bank as Personal Banker. When he's not writing, you can find him exploring different cuisines and binge-watching TV series. Hemanta hopes to write a novel soon. You can check out his work on www.instagram.com/hemantakaushik

[…] you have borrowed in the past, then there will be a record of your credit history with the bank. This is a very effective way of knowing whether or not your loan will be sanctioned […]

Thanks