One of the best approaches that can help you with growing your money would be investments. But investing definitely requires good knowledge. To make investing simple there are several investment platforms that help investors in their investing journey.

Markets tend to be unpredictable during economically stressful times. This may be a perplexing situation for investors wondering if they should invest the money or wait till things settle down.

When the reality is considered, the market is uncertain by nature. Researches have shown that even bad timing in investing pays off more than not being in the market. A prominent research study was done at Harvard ( Assessing the Welfare Costs of Household Investment Mistakes) calculated how much investors forgo when they don’t participate i.e. 4.3% in loss per year.

Sarwa is an investment platform works with an aim to help investors by providing simple and affordable investment options by combining proven investment strategies with technology. It helps its customers in gaining profits over the investments by providing personalized and affordable investment options. Sarwa guides their clients with some simple rules like start early, avoid high fees, diversify and stay disciplined. Sarwa has recognized as Forbes Fintech 20 Startups. It is also the first Fintech company to receive and qualify for Fintech Innovation Testing License (ITL) from the Dubai Financial Services Authority (DFSA).

Sarwa Fees, Features and Account types-

Features:

- 5-minute sign-ups

- Auto-depositing

- Re-investment of dividends

- No lock-in period

- Smart rebalancing

- Tax optimization

- On-demand human advice

- Currently reimbursing bank transfer fees

Account types:

Sarwa offers different investment portfolios like,

- Conventional (Core) Portfolios

- Joint Account Portfolios

- Halal Portfolios

- Socially Responsible Investment (SRI) Portfolios

Fees:

The minimum amount required to start investing in Sarwa: $500. There are No entry or withdrawal fees charged.

Fees: $500 to $50 K – 0.85%/year, Over $50K – 0.7%/year, Over $100K – 0.5%/year

For example, an account with an average monthly balance of $10,000 will have a monthly advisory fee of $6.99. Assuming 30 days in the month and 365 days in the year, the math is as follows: $10,000 * 0.0085 * (30/365) = $6.99.

MyMoneySouq Promotion: MyMoneySouq readers will receive $100 back when funding an account with Sarwa. Just enter Promo code: “MoneySouq20” when prompted.

Minimum account requirements: $2500. Offer valid till December 31, 2020.

Working of Sarwa:

Sarwa works on Nobel prize-winning research “Modern Portfolio Theory” which was developed by the very famous economist Harry Markowitz. He demonstrated that getting good returns and reducing risks can be achieved by diversifying your investments.

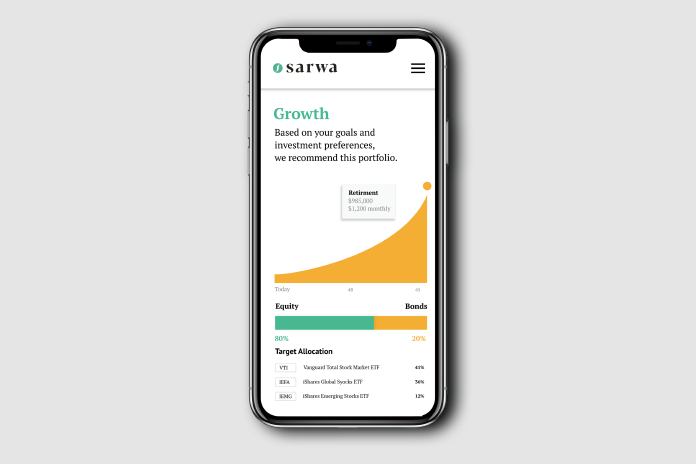

Sarwa’s sign up process involves a short risk assessment questionnaire which helps in determining the customer’s initial risk profile. Through which a customer will be provided a portfolio which is based on the client’s financial goals, time interval, risk tolerance, past experiences in investments and knowledge in it.

However, the results of the assessment keep updating further with the investments experience gained on the portal. Sarwa’s clients can do so by calling them or sending an email and discuss further about your risk tolerance.

Sarwa Promotion:

MyMoneySouq readers will receive $100 back when funding an account with Sarwa.

Just enter promo code: “MoneySouq20” when prompted.

Minimum account requirements: $2500. Offer valid till December 31, 2020.

Sign up now to take advantage of this special offer! *Terms and conditions apply*

Sarwa is known for:

- Beginning investors

- Access to human advisors

- Automatic rebalancing

- Tax optimization

- Socially responsible investors

- Those seeking Halal Investments

About the author

MyMoneySouq helps the visitors to find the right financial product by comparing different products provided by various banks in UAE. It compares different loans, insurance, accounts, credit cards. It works with a goal to give the users a clear idea of what to expect out of their funds and what they can get from those.