What is a Salary Transfer Letter?

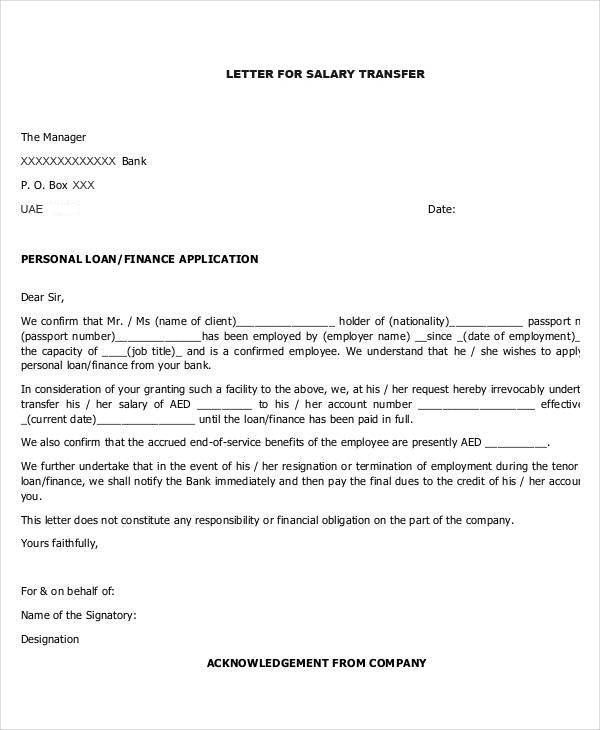

A salary transfer letter is basically a letter issued by an employee’s company, where the employer in a company addresses a letter on the company’s letterhead, mentioning that salary of the employee mentioned in the letter would be credited only to the bank, which will approve the loan.

If an employee gets any year end benefits along with the salary, both the salary along with the benefits will be credited to the bank, mentioned in the letter. The company undertakes that the salary would not be transferred anywhere except the bank that will provide the loan to their employee.

When do you require a salary transfer letter?

Salary transfer letter is like a commitment or a promise on the part of an employer to your bank, that the salary of the employee would be credited to the bank until the loan is completely repaid. The letter will also contain some terms and conditions agreed between your employer and the bank.

Salary transfer letters is one of the must documents, when an employee is applying for a salary transfer loan or a Personal loan in UAE.

When you avail a salary transfer loan, you need to take the entire amount that you earn, and place it in the bank where you have taken the loan, has to be done in the salary transfer letter format. You need to have an agreed amount placed into the bank, every time you receive a payment. You need to mention the entire amount of your salary in the salary transfer letter.

What is the minimum requirement of salary, to avail salary transfer letter?

Usually the banks asks for a minimum required salary of AED 5000 to avail a loan and a salary transfer letter. You also need to be above 21 years of age to avail the same.

Following are the banks that list ‘Salary Transfer letter’ as one of their requirements while giving a loan:

- Arab Bank: While availing a personal loan from Arab Bank, the bank will ask you to submit a salary transfer letter.

- CBI: CBI will ask you to submit a salary transfer letter, while availing a personal loan from their bank.

- HSBC UAE: HSBC UAE also asks you to provide a salary transfer letter with them to avail a personal loan.

- First Abu Dhabi Bank: FAB also asks you to provide salary transfer letter for their loans like personal loan and Buyout loan

- Emirates NBD: Emirates NBD also asks to provide salary transfer letter for all the salaried employees, while availing a loan.

- CBD: There is a requirement of salary transfer letter in CBD.

- RAK Bank: RAK Bank also follows the norm of asking for a salary transfer letter.

Above mentioned banks are few of the many banks, that asks you to provide a salary transfer letter. While going through the minimum requirements for loan in every bank in UAE, you will find salary transfer letter to be one of the top most prioritized documents to avail any loan. Salary transfer letter has become very inevitable and every person availing the loan should take it seriously.

Following is the format of Salary transfer letter, that can be considered while applying for loan:

About the author

Manasa Netrakanti is an avid traveler and writer. Throughout her life, she has travelled to various states across the country and has also been acquainted with various languages and culture. She loves to read various books on Mythology fiction and autobiographies. Manasa wishes to become an author someday, who can inspire the world with her writing.