What is the C3Pay card?

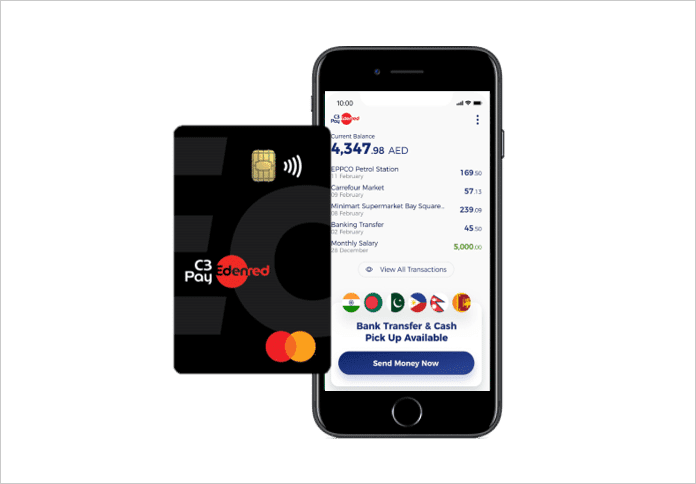

C3Pay card which was previously known as MyC3 card is introduced with a mission to provide corporate customers/large firms an alternative to payroll checks or direct deposit. By using the C3Pay card, carrying huge amounts of cash can be avoided by the cardholders and the recipient can use the card at a wide variety of locations accepting MasterCard, including restaurants and entertainment venues as well as stores, online, or over the phone.

C3Pay card acts as a salary card that and the card holder can use it for withdrawals and purchases across the country, providing them with financial security

Expatriates in the UAE, working for a company or corporation registered with Edenred can instantly withdraw their money from ATMs by using the C3Pay card and enjoy flexible access to their funds.

One of the important aspects of the C3Pay card is that it takes into consideration the requirements of both the employers and the cardholders.

Go through: Top payment gateways in UAE

How to use C3Pay card?

C3Pay card is accepted at all the MasterCard ATM’s in the UAE and across the globe. It will also be accepted at supermarkets, hypermarkets, restaurants, cleaning stores, etc.

Registration of C3Pay card

You can register for the C3Pay card services online by downloading their mobile application on Google Play and App Store.

Services of C3Pay card

You can avail the services of the C3Pay card by using a mobile application(iOS and Android).

The C3Pay card you get will be connected to the mobile application wherein you can access different banking services such as

Card services

- Balance enquiry and transaction history which charges AED 1 for monthly enquiries

- Statement request that costs AED 25 per soft copy

- Local and international mobile recharge

- Request your statements subscribe to SMS security alerts (SMS per transaction) and SMS salary alerts

Money transfer (remittance)

By using the C3Pay mobile app and RAK money transfer, you can transfer funds anywhere, anytime with the best exchange rates and affordable fund transfer fees.

Benefits of C3Pay card

C3 cards hold many benefits and here are some of them

- A convenient looking dashboard with the option of transfer money, instant mobile recharge, SMS security alerts, updates on COVID-19

- Detailed transaction history is provided

- Withdraw money at ATM machines

- Instant money transfers between C3Pay cardholders

- An easy option to block/unblock the card or to request the replacement of the card

- Customer service number 600567772 to help with any issues regarding the card

- Whatsapp support channel for money transfers queries

- Updated exchange rates for international money transfers powered by RAKBANK

Steps to follow to keep your card safe

- Don’t ever share your PIN with anyone

- Don’t write your PIN on the back of your card

- Don’t enter your PIN more than twice while using the ATM machine as your card might get blocked.

- If you lost or forgot your card, get in touch with the call center immediately

- You can find the contact details of the call center on the back of the payroll card

Service fees of C3Pay card

| Service | Fees |

| Balance Enquiry via call center | Free |

| Balance Enquiry Via C3Pay app | AED 1 (unlimited requests) |

| Balance Enquiry in the UAE at C3Pay ATMs | Free |

| Balance Enquiry in the UAE at other ATMs | AED 2 per transaction |

| Cash Withdrawal fees in the UAE at C3Pay ATMs | Free |

| Cash Withdrawal fees in the UAE at other ATMs | AED 2 per transaction |

| Soft copy of Statement | AED 25 per statement |

Note: Any service fee that is not mentioned above can be known by contacting the C3Pay call center.

Things to remember about C3Pay card

- The first thing to keep in mind regarding this card is that C3Pay card is not a credit card and thus holds no limit while you are using it to draw your money.

- You can use the C3Pay card at any supermarkets that accept the card, at the banks and at the ATM machines to withdraw money

- The written statement will not be given to you when you withdraw the money. However, you can know the details of your balance through the app.

- If you want a printed statement, it will be given on request to you if you pay certain fees that will be debited from your account immediately

- Any disputes or claims of your card will only be accepted in writing and that too not more than 15 days from which the incident has taken place

- The claim notice should contain the info like employee ID, your name and card number

- The card member can inform about the loss or theft of the PIN to the call center within a span of 24 hours.

- If the employer cancels the C3Pay, C3Pay applies a monthly fee of AED 20 on the remaining balance and if no balance is available in the payroll card, it will be immediately cancelled.

- C3Pay can change the terms and conditions at any point of time and you can go through them on the app

On a whole, C3Pay card eases the transactions for employers, cardholders etc., by providing user-friendly services to the people in a secure way possible.