Credit cards have always been the subject of a conundrum. If used properly and responsibly, it can turn your daily spending’s into rewards. But it will only stay an asset as long as you don’t start taking it as free cash. Most people boast about credit cards being very helpful and rewarding for them, at the same time there are people who are in neck deep debt due to credit cards. Hence it all boils down to one question “Can you handle a credit card?” and to answer that you will first need to understand and evaluate yourself.

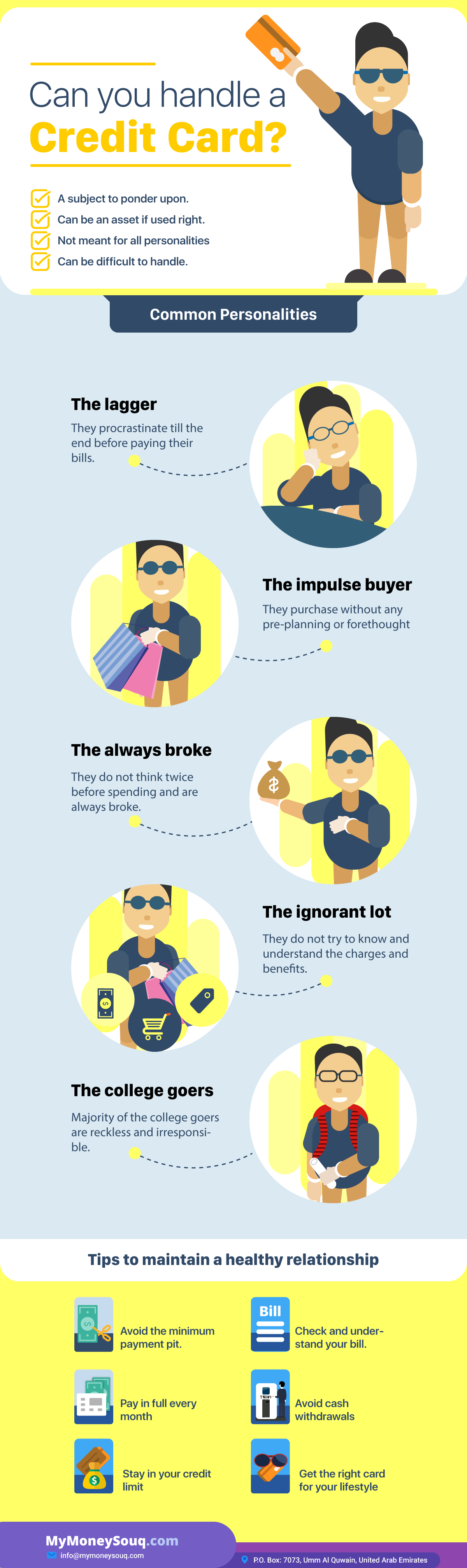

Personalities who would find it hard to handle a credit card.

If you fall into one of the following personalities, then maybe you should reconsider using it

- The lagger: This particular type of personalities are not hard to spot in the crowd. They procrastinate till the end before paying their bills. Laggers are well known to cross their due date of bills.

- The impulse buyer: The impulsive buyer as the name suggests are the ones who make their purchases in the heat of the moment, without any pre-planning or forethought. They are the most vulnerable of the lot.

- The always broke: This is the type of person who does not think twice before spending. They are always broke because the concept of saving and planning is not present.

- The ignorant lot: The lot who does not bother to try knowing and understanding the schedule charges and benefits that come with the credit card.

- The college goers: Though not all, but a majority of the college goers are reckless and irresponsible, a credit card can become a huge liability for them.

Some tips to best maintain a healthy relationship with your credit card:

Now that we have listed a few personalities for whom credit card could be lethal. Here are some plans you can abide by to avoid making your credit card a liability.

- Minimum payment pit: What we usually do is that we just pay off the minimum payment that needs to be paid every month, since it is a very small amount. But paying just this minimum amount will prove to be expensive for you in the long run. This will result in repayment for years and you will end up paying more with interest than the original debt.

- Check and understand your bill: In the beginning, it will be hard for you to understand every single terminology. Raise queries, understand every single charge. This will help you to understand if the credit card is actually helping or becoming a liability.

- Pay in full every month: As talked about the first point, it is never healthy to carry the balance. Always make sure that you are paying off full every month. This will also help you curb your expenses.

- Avoid cash withdrawals: One should always remember, credit cards are not debit cards. The cash withdrawal charges for credit cards are very steep. This has the potential to burn a hole in your pocket.

- Stay in your credit limit: Know your limit and stay within it. If necessary, call your card provider and get your credit limit increased. But do so only if you are sure that you can comfortably repay the increased limit.

These were some basic tips that every card owner should follow. Credit cards are and can remain a substantiated source of finance, provided you maintain a healthy relationship with it. There are a number of banks providing credit cards in UAE with offers for various specific activities such as dining, shopping, traveling. Make sure you are well aware of your lifestyle spending habits and opt for that card which best compliments it.

About the author

Hemanta Bijoy Kaushik is a personal finance writer. Discovering his love for writing, he has written a number of blogs on personal finances and other genres on various digital media platforms. He has completed his MBA from IMT and currently working at HDFC bank as Personal Banker. When he's not writing, you can find him exploring different cuisines and binge-watching TV series. Hemanta hopes to write a novel soon. You can check out his work on www.instagram.com/hemantakaushik