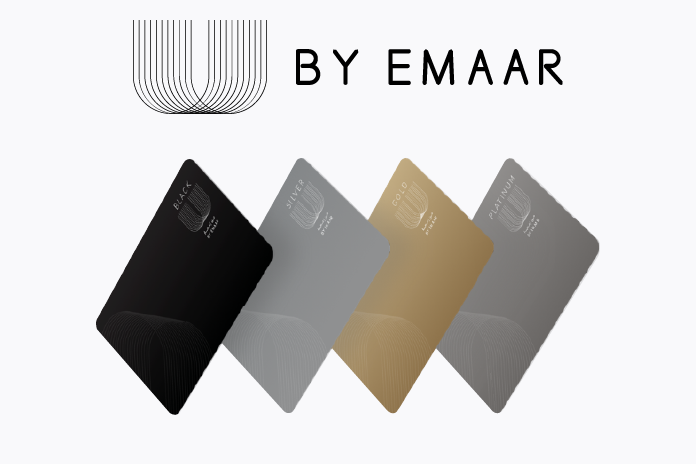

Emaar Hospitality Group launched a loyalty program known as “U by Emaar”. U by Emaar provides membership cards which can be used to avail lifestyle, shopping, travel and much more benefits. The usage of “U by Emaar” membership card will generate “U points” which can be redeemed for high lifestyle and other privileges.

Check: All about Shukran Card

Eligibility

U by Emaar membership can be availed by any UAE resident of a particular age of majority of their particular place.

Membership cards and benefits

U by Emaar provides 4 different variants of membership cards that are Black, Silver, Gold and Platinum tiers. The discounts and offers provided at the outlets varies with these tiers.

Black tier

- Provides base U points up to 9999

- Can avail 10% OFF on dining at selected restaurants

- Can get 10% OFF on hotel stays

Silver tier

- Provides 10,000+ base U points

- Can get 20% OFF on dining bill

- Can avail 10% OFF on stays at selected hotels and get additional perks at the hotels like late checkout

Gold tier

- Provides 25,000+ base U points

- Can get 25% OFF on dining bill

- Can avail 10% OFF on stays at selected hotels

- Can get additional perks at hotels like free breakfast buffet, late check out, room upgradations, etc.

- Can get 10% off on Spa

- Free popcorn and a cold drink at Reel Cinemas

Platinum tier

- Provides 60,000+ base U points

- Can get 30% OFF on dining bill

- Can avail 10% OFF on stays at selected hotels

- Can get additional perks at hotels like free breakfast buffet, late check out, room upgrations, etc.

- Can airport transfer facility to and from Dubai International Airport

- Can get 20% off on Spa

- Free popcorn and a cold drink at Reel Cinemas

- Can get 30% OFF at Dubai Opera

- Can get 20% OFF at Arabian ranches golf club and Dubai Polo & Equestrian club

- Complimentary access to the lounge at Dubai mall and Fashion Avenue

- Can get 2% OFF on land registration fee at Emaar Properties

What are U points?

Apart from the membership privileges provided, UbyEmaar also offers U points. These points are generated on every AED spent on dining, stay, leisure, etc.

U by Emaar members can earn 1 U point on every 1 AED spent on dining, relax and many other privileges. These U points can be redeemed for lifestyle, leisure and entertainment benefits. On spending made on play and at Rove hotels can earn 2 AED = 1 U point.

Also, check: FGB Reward points

How to avail U by Emaar membership?

U by Emaar membership can be availed online on visiting their U by Emaar portal. Interested individuals can sign up on their portal for the loyalty program and pick a membership tier according to their preference and fill out the basic details. Black tier members can get their membership card on visiting the partnered brand outlets and provide the registered mobile number.

Other tiers card applicants will get the membership card through courier. The card will have the member’s name and card validity details. It will take 4-6 weeks for the member to receive the membership card.

Points to be noted

There are certain points to be noted while signing up for the “U by Emaar” loyalty program, like,

- Only individuals are eligible for the loyalty program

- The U points earned are eligible for 24 months from the date they are earned

- U points can be earned only at their participating brands and outlets

U by Emaar is a beneficial loyalty program launched by Emaar. The exclusive discounts and benefits provided on the membership to the program can help an individual save a lot of money on their expenses at restaurants, hotel stays, movies and other leisure categories.

About the author

MyMoneySouq helps the visitors to find the right financial product by comparing different products provided by various banks in UAE. It compares different loans, insurance, accounts, credit cards. It works with a goal to give the users a clear idea of what to expect out of their funds and what they can get from those.